Tax Deducted at Source (TDS) for Indian Freelancers

The government of India has introduced an income tax called Tax Deducted at Source or TDS as part of their Income Tax Act. E-commerce companies operating in India such as ourselves are required to deduct TDS on client payments received by freelancers residing in India.

TDS collection starts from October 1st 2020. Note that this was previously set to April 1st 2020 and was later amended by the Indian government. Those who were charged TDS from April to September 2020 were already refunded on the platform.

How is TDS deducted?

For freelancers and agencies who have not provided a PAN, we will withhold 5% of all your earnings on the platform from when TDS was implemented.

For freelancers classified as Specified Person, 5% of your earnings will be withheld, whether or not you have PAN in your account.

For those freelancers and agencies who have provided a PAN, we will withhold 1% of your earnings if:

- you have earned 500,000 INR and over in the current financial year (starts from March to April of the following year), or

- Regardless if you opted-out from TDS, the moment you reach the threshold, TDS will be automatically deducted from all payments that you received within the financial year.

- To illustrate, let's say from March 2022 to January 2023, you received Milestone Payments totaling 450,000 INR. On February 1, 2023, you received a Milestone Payment of 50,000 INR, making your total earnings for the financial year 500,000 INR. Since you have hit the threshold, TDS will be deducted from the 50,000 INR that you just received and the 450,000 INR that you accumulated for that financial year. Payments that you will receive until March 2023 will also be subjected to TDS.

- you declared that you will earn more than the threshold in a financial year.

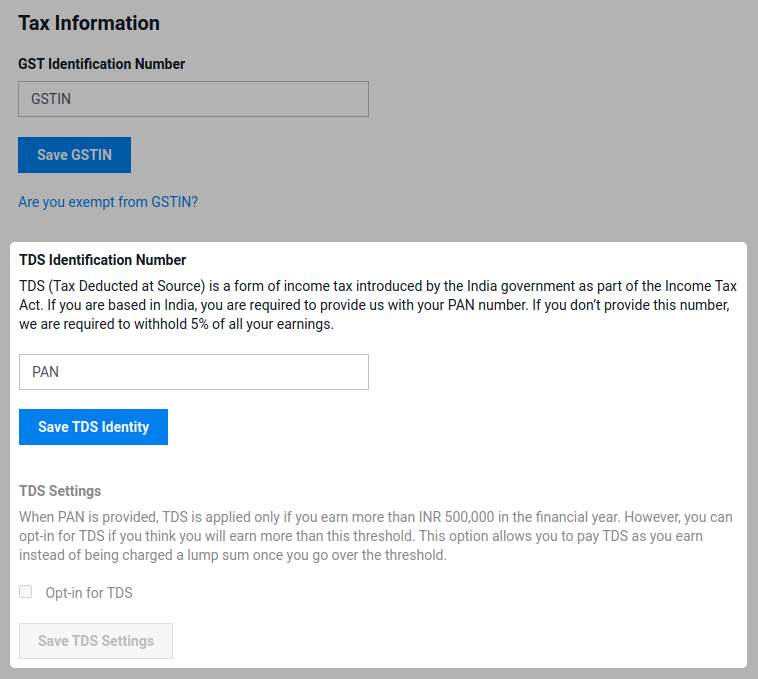

To manage your TDS setting, follow these steps:

1. Click your profile picture thumbnail from the main menu bar, and choose Settings.

2. Click Payment & Financials.

3. Go to the Tax Information section.

4. Under TDS Identification Number, input your PAN in the text field.

5. Click Save TDS Identity to complete.

6. (Optional) Tick Opt-in for TDS if you think you will exceed the threshold of 500,000 INR earning to avoid getting charged a lump sum once you go over the threshold.

16A certificates generated for you will be available in the Tax Statements tab once available.

Inoperative and Invalid PANs

If your PAN is found invalid or inoperative*, we may at anytime, remove it from your account. In such cases, a 5% TDS will apply unless you add a valid and operative PAN.

* The Central Board of Direct Tax in India issued a circula to link the PAN with Aadhaar card for which the last date is June 30,2023. Since July 1, 2023, PANs are being tagged "Inoperative" if a user fails to link their Aadhaar card to their PAN. Those with Inoperative PAN will be deducted at a higher rate ie. 5% in accordance with the provisions of section 206AA.

Note: All collected tax will be remitted to the Indian government. For assistance in claiming tax refund and for other tax-related inquiries, we strongly advise for you to contact your local tax advisor to get accurate recommendations.

Disclaimer: Freelancer and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors.

Last update: November 28, 2023